MADISON, Wis. — With Qualcomm’s acquisition still pending, NXP Semiconductors’ automotive business unit kept a relatively low profile in 2017. That hiatus, however, will end with a modest bang come next week at the Consumer Electronics Show in Las Vegas.

Among several new developments NXP will highlight at the show is the disclosure that LG Electronics is its key automotive tier one partner. Together with Hella, which is offering algorithms expertise, LG and NXP will be pushing NXP’s S32V-based Automotive Vision Platform for ADAS and autonomous vehicles.

Second, NXP is unveiling an expanded automotive radar portfolio, including a very high-resolution imaging sensor. NXP’s portfolio will now cover long-, mid-, and short-range radar requirements.

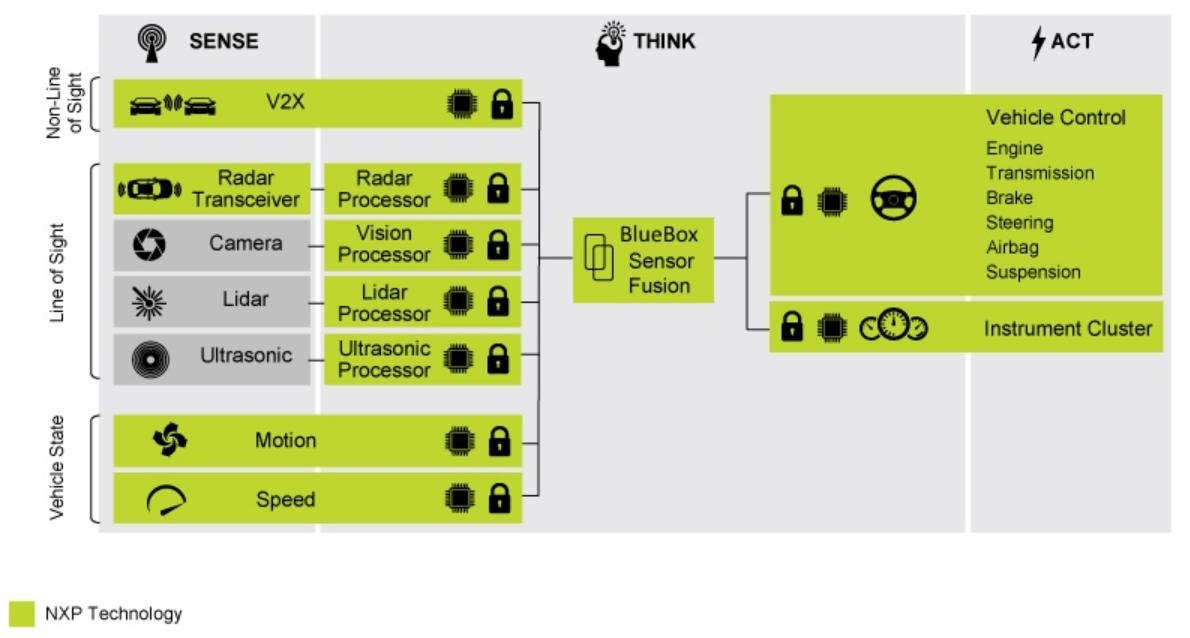

NXP will also be rolling out an Automated Drive Kit based on its Bluebox 2.0 platform — a so-called AV brain. Combined with software and middleware developed by AutonomouStuff, NXP is pitching its Automated Drive Kit as a solution for tier ones and OEMs looking for an “open, fast and flexible” AV development platform.

An added development is NXP’s announcement last month that its chips (Bluebox, mmWave radar, V2X, security, etc.) will support Baidu’s Apollo Open Autonomous Driving Platform — otherwise known to the world as “Android for robocars.”

(Source: NXP)

Click here for larger image

Open platforms

What appears to be a host of disparate announcements has a common underlying theme: NXP wants to be known as a strong advocate of “open platforms” for ADAS and AVs. In an era of fast-paced AV development, chip giants such as Intel/Mobileye and Nvidia are constantly undercutting automotive tier ones by directly working with car OEMs.

In contrast, NXP sees its role as a key partner to tier ones, helping them preserve their added value as system integrators. “As the largest automotive semiconductor supplier, we could talk about how we envision a whole vehicle should look like, but we shouldn’t be competing with tier ones. That wouldn’t help us scale our chip business,” Lars Reger, chief technology officer of NXP's automotive business unit, told us. “As CTO of NXP Automotive, I see my job in offering as many pieces of Lego blocks as possible. I invite more people to play with our stuff.”

Considering that NXP has been around the automotive electronics space for a long time, Phil Magney, founder and principle advisor of VSI Labs, observed that NXP understands the important role of tier ones better than anyone. Magney stressed to never underestimate a vital role that tier ones will play in the era of automated vehicles.

“Tier ones are the bridge between the AV stack and the vehicle platforms,” Magney said. After all, traditional vehicle systems (steering, suspension, chassis/body, powertrain) need to be reengineered for AV deployment, he added.

Meanwhile, both Intel/Mobileye and Nvidia, in contrast, are locking down their AV platform so that anyone interested in building a robocar can adopt their turnkey system. NXP calls this a “closed system.”

What then might be the downside of a closed system?

Reger said, “There is no technical downside in the closed system.” But in his opinion, such an approach can adversely affect the positioning of a tier one’s business. Because NXP supplies a variety of chips inside many vehicles, “it doesn’t make sense for us to compete with tier ones. We need to do business with Conti, Delphi, Bosch and everyone else.”

How important is a deal with LG Electronics?

LG Electronics (LGE) is the first tier one NXP has publicly disclosed as a partner for the S32V Automotive Vision Platform. Reger said, “There is a big car OEM behind [LGE],” but said he can’t disclose the company’s name.

VSI Labs’ Magney noted, “LGE is already a player in sensors such as their camera technologies which is used by Mercedes. The NXP deal builds upon this as they are working together to offer an alternative to Mobileye.”

Danny Kim, director of VSI Labs, described LGE as “a very competitive tier one player in infotainment and telematics space already.” The Korean giant is now "expanding its capabilities into automotive safety domain starting with its camera-based vision systems," he added.

S32V234 is NXP’s second-generation vision processor family designed to support computation intensive applications for image processing. It’s said to be suited for ADAS, NCAP front camera, object detection and recognition, surround view, machine learning and sensor fusion applications.

Reger sees that many carmakers and tier ones don’t want a single vision acceleration approach. They prefer to explore different types of accelerators to improve computation per watt. Accelerator options NXP offers include IP coming from CogniVue (acquired by Freescale) and Layerscape processors developed by NXP’s digital networking group.

While S32V comes with deterministic algorithms necessary for its vision processors, who are supplying AI algorithms for the vision platform? Without access to AI expertise from a company in San Diego [meaning Qualcomm], NXP’s S32 is currently offering AI algorithms provided by Hella Aglaia, according to NXP.

News sources:EET US

Return